"Reverse VAT" विषय पोस्ट करनेवाला व्यक्ति: Michael Newton

|

|---|

Michael Newton

संयुक्त राज्य अमरीका

Local time: 07:01

जापानी से अंग्रेजी

+ ...

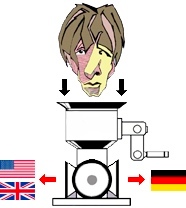

I have a client in Germany that requires (1) my VAT and (2) a "reverse VAT" on my invoice. As I am of US nationality and the US does not have a VAT system, I have no difficulty in explaining to the client that I cannot provide this. However, I am stymied by "reverse VAT". The internet indicates that this is required for "building and construction" while the only service I have provided to the client is a translation from Chinese to English worth USD 200. Could someone please explain to me what t... See more I have a client in Germany that requires (1) my VAT and (2) a "reverse VAT" on my invoice. As I am of US nationality and the US does not have a VAT system, I have no difficulty in explaining to the client that I cannot provide this. However, I am stymied by "reverse VAT". The internet indicates that this is required for "building and construction" while the only service I have provided to the client is a translation from Chinese to English worth USD 200. Could someone please explain to me what this involves? I would be extremely grateful! (btw, the translation was sent from the US to Germany by email, nothing complicated involved). ▲ Collapse

| | | |

Angela Malik

यूनाइटेड किंगडम

Local time: 12:01

जर्मन से अंग्रेजी

+ ...

| The internet is wrong, but you are not | May 16, 2022 |

Reverse VAT is an internal EU (and UK) term that just means that no VAT is charged on a service that would normally require VAT because the parties will report the VAT in their own countries. It may well apply to construction, but it also applies to translation. I'm based in the UK and am VAT-registered, and all of my invoices to EU-based clients have a "reverse VAT" line.

However, if you are based in the US and not part of the VAT system, then you are correct that VAT (and reverse ... See more Reverse VAT is an internal EU (and UK) term that just means that no VAT is charged on a service that would normally require VAT because the parties will report the VAT in their own countries. It may well apply to construction, but it also applies to translation. I'm based in the UK and am VAT-registered, and all of my invoices to EU-based clients have a "reverse VAT" line.

However, if you are based in the US and not part of the VAT system, then you are correct that VAT (and reverse VAT) do not apply. ▲ Collapse

| | | |

Sebastian Witte

जर्मनी

Local time: 13:01

सदस्य (2004)

अंग्रेजी से जर्मन

+ ...

| I always thought the UK is not part of the EU VAT system ... | May 16, 2022 |

... as it is not part of the EU. I will need to look into this. I won't ask my tax advisor because then I'll have to pay again.

| | | |

Samuel Murray

नीदरलैंड

Local time: 13:01

सदस्य (2006)

अंग्रेजी से अफ्रीकान

+ ...

| What is the German word? | May 16, 2022 |

Michael Newton wrote:

I have a client in Germany that requires (1) my VAT [number] and (2) a "reverse VAT" on my invoice.

I suspect the German client is talking about shifted VAT. VAT shifting only applies if both parties are in the EU. You should explain to the client that you are not in the EU, that you do not have an EU VAT number, and that you are therefore unable to shift VAT to him (or have him shift VAT to you). He should find out from his own tax authorities (or a bookkeeper in his own country) how to deal with invoices from service providers outside of the EU.

Sebastian Witte wrote:

I always thought the UK is not part of the EU VAT system as it is not part of the EU.

As a Dutch translator I no longer shift VAT to my UK clients (and I don't need to put their VAT number on my invoice), but it may be different for a UK *translator*. The UK now has its own VAT laws, and perhaps UK translators still need to [attempt to] shift VAT to their EU clients.

[Edited at 2022-05-16 09:58 GMT]

| | |

|

|

|

No VAT for EU or anywhere else outside UK now.

Reverse VAT is/was the client’s problem and doesn’t go on an invoice anyway. It just meant the client paid VAT on your services in their own country rather than to you and the UK government.

| | | |

Angela Malik

यूनाइटेड किंगडम

Local time: 12:01

जर्मन से अंग्रेजी

+ ...

| Germany and "reverse charge" | May 16, 2022 |

Almost all of my clients are based in Germany or Austria. While the UK is now outside of the EU VAT system, the way services are supplied and invoiced is largely the same as before. The only difference is that since the place of supply is the EU and therefore outside of UK VAT scope, no VAT is applicable for me.

However, the client still accounts for their VAT using the reverse charge procedure, and German accountants are notoriously picky for wanting a reverse charge line on the in... See more Almost all of my clients are based in Germany or Austria. While the UK is now outside of the EU VAT system, the way services are supplied and invoiced is largely the same as before. The only difference is that since the place of supply is the EU and therefore outside of UK VAT scope, no VAT is applicable for me.

However, the client still accounts for their VAT using the reverse charge procedure, and German accountants are notoriously picky for wanting a reverse charge line on the invoices. I don't have a single client who wouldn't insist on having this information on the invoice. So I just let them have the reverse charge line. It doesn't matter to me: I have plenty of proof that the customer is outside of the UK and therefore not VAT relevant anyway. ▲ Collapse

| | | |

RobinB

संयुक्त राज्य अमरीका

Local time: 06:01

जर्मन से अंग्रेजी

| "Reverse charge mechanism" | May 17, 2022 |

Hi Michael,

It's actually also called the "Reverse-Charge-Mechanismus" (or even "Reverse-Charge-Mechanism") in German(!).

All you need to do is add the following boilerplate to your invoices and everyone will be happy:

"Auf die Steuerschuldnerschaft des Leistungsempfängers gem. § 13b Umsatzsteuergesetz wird hingewiesen.

Attention is drawn to the VAT liability of the recipient of these services in accordance with section 13b of the German VAT Act."... See more Hi Michael,

It's actually also called the "Reverse-Charge-Mechanismus" (or even "Reverse-Charge-Mechanism") in German(!).

All you need to do is add the following boilerplate to your invoices and everyone will be happy:

"Auf die Steuerschuldnerschaft des Leistungsempfängers gem. § 13b Umsatzsteuergesetz wird hingewiesen.

Attention is drawn to the VAT liability of the recipient of these services in accordance with section 13b of the German VAT Act."

The point is that if your invoice does not feature this boilerplate, the German tax authorities can and may refuse to recognize your invoice, which is probably not going to be good for client relations. And of course you should tell your client that you don't have a VAT ID because you're not in the EU: unless the client is not VAT-registered (mainly retail clients and government agencies), in which case you have to apply for an "EU VAT ID" and obtain an EU VAT ID, and you then charge and remit the relevant VAT to a national VAT authority in the EU (which doesn't have to be the country you're selling your services to).

Robin ▲ Collapse

| | | |

Michael Newton

संयुक्त राज्य अमरीका

Local time: 07:01

जापानी से अंग्रेजी

+ ...

विषय आरंभकर्ता

An enormous thank-you to Angela, Sebastian, Samuel and Robin for explaining this problem for me. I will put the boilerplate into the invoice and avoid some sleepless nights. Friends in need are friends indeed. Danke, spasibo, grazie!

| | | |